Aave (AAVE), Compound (COMP) and Maker (MKR) might offer buy opportunities: Santiment

Aave and the three other tokens COMP, MKR and REN have shown ‘clear price bottoms recently’, according to on-chain analytics platform Santiment.

Aave’s price has dipped 2.5% in the past 24 hours and nearly 15% over the past week as of writing, with the altcoin’s price falling alongside that of major cryptocurrencies such as Bitcoin and Ethereum.

The top two crypto assets by market cap are down 4% and 3.3% respectively amid a slowdown across the markets, with sentiment driven by inflation concerns, the US Federal Reserve’s move to hike rates and tensions related to the Russia-Ukraine crisis.

While cryptocurrencies are likely to trade lower as they mirror losses in the equities market, Santiment has noted that Aave (AAVE), Compound (COMP), Maker (MKR) and Ren (REN) could offer a great buy opportunity in the short term.

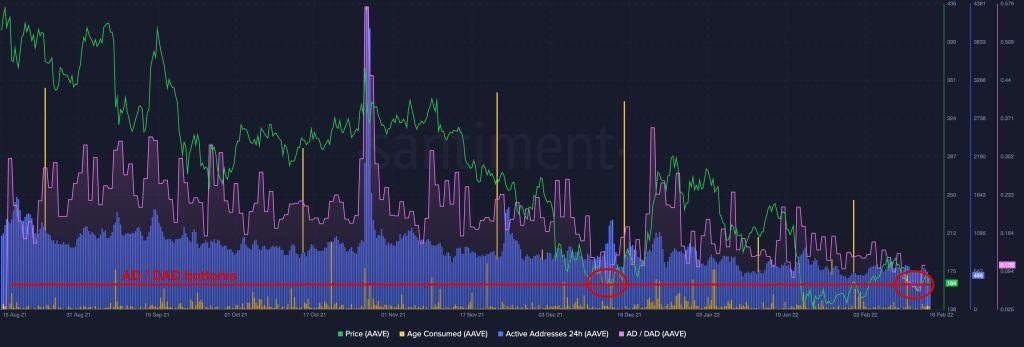

In a “spotting the dips” analysis, Santiment points to the ratio of active deposits to daily active addresses (AD/DAD) to highlight that the four altcoins could be trading at “clear bottoms.”

“AAVE, COMP, MKR, and REN have all shown very clear price bottoms recently. And they have all been accurately predicted by looking at how many active deposits have made up the total address activity of [the] asset,” the analytics platform noted.

Aave (AAVE)

Looking at Aave, Santiment notes:

“Looks like price likes to grow from this metric’s bottom. We could suggest that low values of AD/DAD ratio are indicating a nice buy opportunity.”

AAVE chart showing the AD/DAD ratio. Source: Santiment.

AAVE chart showing the AD/DAD ratio. Source: Santiment.

On the likelihood of opposite price action, the platform shared:

“Higher levels of AD/DAD indicate ‘exit’ points, where holders probably tend to exit their positions. The higher deposits (AD), the higher holders ‘panic’ level.”

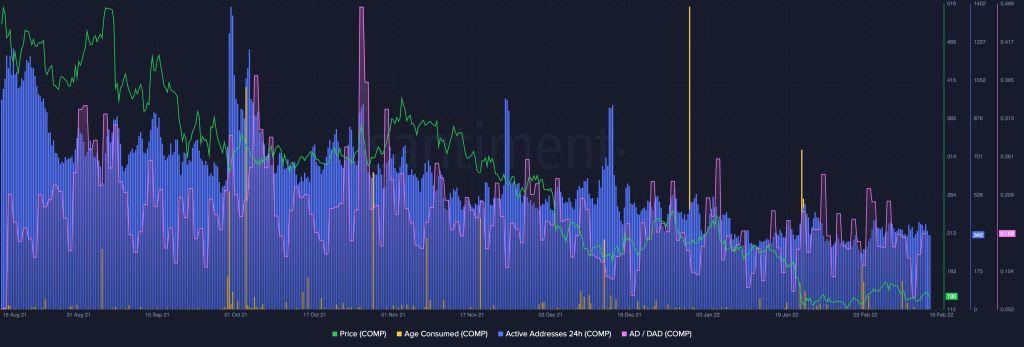

Compound (COMP)

Santiment suggests Compound (COMP) is also poised for an upside. “Compound’s AD/DAD dipped to all time low just a few days ago. Good sign,” they wrote.

Compound chart showing the dip in the active deposits to daily active addresses. Source: Santiment

Compound chart showing the dip in the active deposits to daily active addresses. Source: Santiment

Maker (MKR)

Maker’s AD/DAD also shows the latest dip has pushed prices to a decent buy level. However, it’s likely to dip even more after reaching current levels at the end of January. Santiment says the ratio could surge more, indicating further declines, but “not as strong as other tokens.”

REN (REN)

REN/USD touched year-to-date lows on 24 January, with a decent spike in February helping it break above $0.40. However, an 11% dip over the past seven days has left it battling pressure around $0.35.

Another “panic” move to recent lows could offer a fresh buying opportunity.

The post Aave (AAVE), Compound (COMP) and Maker (MKR) might offer buy opportunities: Santiment appeared first on Coin Journal.