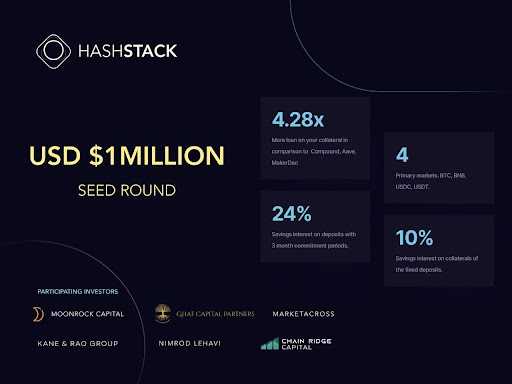

Hashstack Finance closes $1M seed round

Hashstack Finance announced completion of a $1 million see funding round. This took place right after its launch of the Open Protocol testnet, CoinJournal learned from a press release.

Hashstack funds invested in new talent and Open Protocol development

Hashstack will use the funds to attract talent, continue developing the Open Protocol, and grow the community.

Among the well-known investors to take part in the round are GHAF Capital Partners, Kane & Rao Group, Moonrock Capital, Nimrod Lehavi, Chainridge Capital, and MarketAcross.

Hashstack Finance founder Vinay commented:

Bringing under-collateralization to the DeFi is critical to our mission at Hashstack. We are grateful to be backed by some of the smartest money in this ecosystem. The funds raised will be utilized towards talent acquisition, product development, and growth.

Kevin Kurian, General Partner at Kane & Rao Group added:

Getting the maximum value out of your assets is essential in any market. Hashstack offers a solution that the market has not really seen before. We backed Vinay and his team at Hashstack with our capital to bring forward these new ideas.

Only product with up to 1:3 collateral-to-loan ratio

Hashstack’s Open Protocol is the only autonomous lending solution in DeFi that enables non-custodial, under-collateralized loans up to 1:3 collateral-to-loan ratio.

It means you can borrow up to $600 by providing only $200 as collateral. Of this, you can withdraw $140 (i.e. up to 70% collateral) while using $460 for in platform trading.

Open Protocol can offer under-collateralized loans immediately regardless of whether you need to borrow for trading capital, personal cash needs, or leveraged investments in IDOs.

Simplex CEO Nimrod Lehavi said:

DeFi lending is at its inflection point. Hashstack smartly circumvents the need for on-chain credit score in order to facilitate under-collateralized loans. Hashstack has the potential to be one of the pioneers of Layer – 3 enabler solutions.

Three-pronged approach to accelerate DeFi lending growth

Open Protocol applies to following approach to eliminate inefficiencies from the DeFi ecosystem:

- Effective asset utilization through diversification of available assets via lending and providing trading capital

- Clear compartmentalisation of APY and APR of deposits/loans with that of their minimum commitment period (MCP)

- Under-collateralized loans

Feras El Sadek of GHAF Capital Partners said:

All our companies including Hashstack hold a great value to us. We at Ghaf Capital are very excited to back Hashstack as we view them as an essential cog in the crypto ecosystem, solving major issues to allow the blockchain space to go mainstream, making crypto accessible and affordable to billions of people all over the world.

I personally admire how they push to add value to the whole system of the blockchain world. We in Ghaf Capital Partners hold similar values in that sense. We always push start-ups to do more and help support their growth continuously. It’s great to see others be a part of our company’s mission.

The post Hashstack Finance closes $1M seed round appeared first on Coin Journal.