Market Extra: Pair of Wall Street firms see Friday’s job data coming in way above consensus

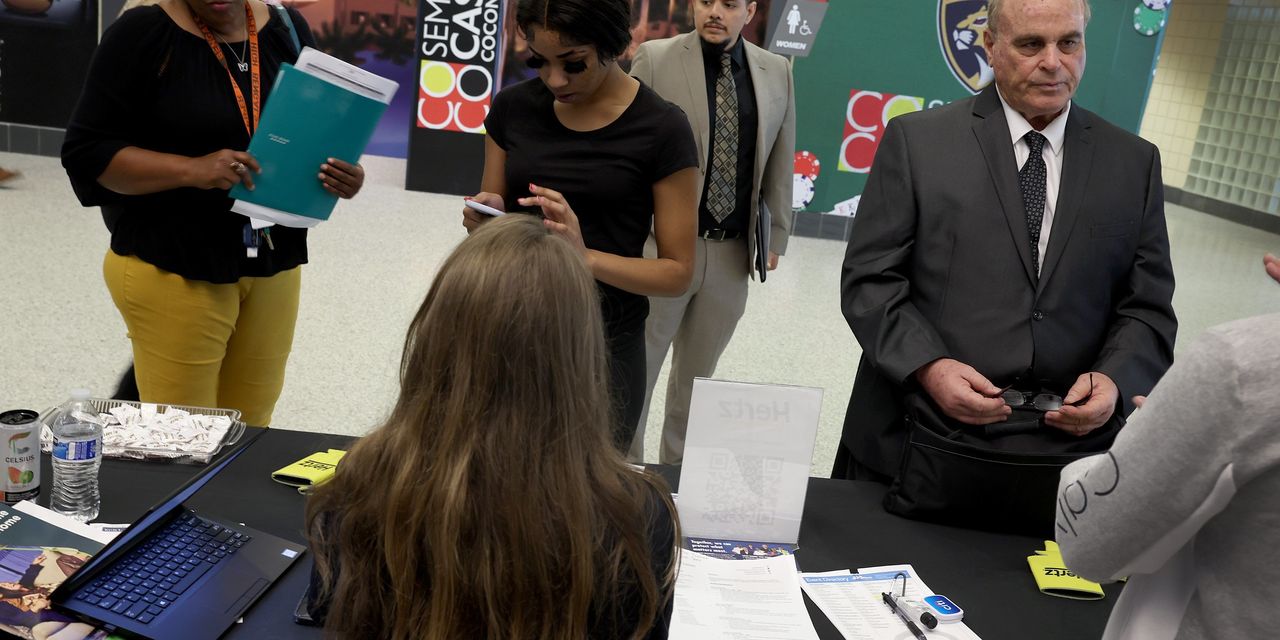

Joe Raedle/Getty ImagesFriday’s nonfarm payrolls report for February is likely to come in way above consensus estimates, reinforcing the trend seen in January’s data, according to a pair of Wall Street firms.Economists at Deutsche Bank DB expect to see a job gain of 300,000, citing February’s mild weather as one likely influence. Aneta Markowska and Thomas Simons, economists at Jefferies JEF, said they foresee a gain of 290,000 for last month. Economists surveyed by The Wall Street Journal, on average, expect February payrolls to have grown by 225,000.A stronger-than-expected jobs report has the potential to trigger another round of repricing in financial markets similar to the one seen after January’s nonfarm payroll report. As of Monday afternoon, a day before the start of Federal Reserve Chairman Jerome Powell’s semiannual testimony to Congress, all three major U.S. stock indexes DJIASPXCOMP were moving higher, while Treasury yields were little changed.“February’s jobs data probably has more of an ability to move markets than January’s report because there’s very heightened sensitivity to any suggestion of the economy overheating,” said Will Compernolle, a macro strategist at FHN Financial in New York. “January’s data was really hot, but because of seasonal-adjustment issues, markets are still clinging on to the hope that it was a bit of a fluke. If it’s a really above-consensus jobs report, that will be under the magnifying glass much more so than if it is below consensus, in which case markets would look past it as insufficient comfort.”Read: Why the February jobs report is unlikely to reverse a January blowout in this week’s key economic data releaseThe 10-year Treasury yield BX:TMUBMUSD10, a benchmark rate for everything from mortgages to student and automobile loans, hovered around 3.96% Monday, down from an intraday high of 4.08% reached last week.

Market Pulse Stories are Rapid-fire, short news bursts on stocks and markets as they move. Visit MarketWatch.com for more information on this news.