Russia in Ukraine: Let Loose the Dogs of War!

As the world’s attention is focused on the war in the Ukraine, it is the human toll, in death and injury, that should get our immediate attention, and you may find a focus on economics and markets to be callous. However, I am not a political expert, with solutions to offer that will bring the violence to an end, and I don’t think that you have come here to read about my views on humanity. Consequently, I will concentrate this post on how this crisis is playing out in markets, and the effects it has had, so far, on businesses and investments, and whether these effects are likely to be transient or permanent.

The Lead In

To understand the market effects of the Russia-Ukraine conflict, we need to start with an assessment of the two countries, and their places in the global political, economic and market landscape, leading in. Russia was undoubtedly a military superpower, with its vast arsenal of nuclear weapons and army, but economically, it has never punched that weight. Ukraine, a part of the Soviet Union, has had its shares of ups and downs, and its economic footprint is even smaller. The pie chart below, provides a measure of the gross domestic product of Russia and Ukraine, relative to the rest of the world:

While Russia’s share of the global economy is small, it does have a significant standing in the natural resource space, as a leading producer and exporter of oil/gas, coal and nickel, among other commodities. Ukraine is also primarily a natural resource producer, especially iron ore, albeit on a smaller scale.

Russia was also a leading exporter of these commodities, with a disproportionately large share of its oil and gas production going to Europe; in 2021, Russian gas accounted to 45% of EU gas imports.

The Market Reaction

As the rhetoric of war has heated up in the last few months, markets were wary about the possibility of war, but as Russian troops have advanced into the Ukraine, that wariness has turned to sell off across markets. In this section, I will begin by looking at the bond market effects and then move on to equities and other asset classes, starting by looking at the localized reaction (for Ukranian and Russian securities) and then the global ripple effects.

Bond Markets and Default Risk

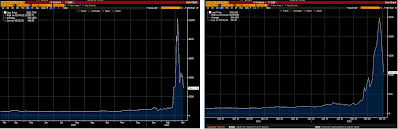

In times of trouble, the first to panic are often lenders to the entities involved, and in today’s markets, the extent of the reaction to country-level troubles can be captured in real time in the sovereign CDS (Credit Default Swap) markets. The graph below shows the sovereign spreads for Russia and Ukraine in the weeks leading up and including the conflict:

|

| Change in Sovereign CDS, by Region |

There are no surprises in this table, with the effects on spreads being greatest for East European countries. Note, though, that while sovereign CDS spreads increased almost 51% between January 1, 2022 and March 16, 2022, in these countries, the overall riskiness of the region remains low, the average spread at 1.30%. The Middle East is the only region that saw a decrease in sovereign CDS spreads, as oil, the primary mechanism for monetization in this region, saw its price surge during the last few weeks. The Canadian sovereign CDS spread widened, but US and EU country spreads remained relatively stable.

Lenders may be the first to worry, when there is a crisis that puts their payments at risk, but equity investors are often with them, pushing down stock prices and pushing up equity risk premiums. Again, I will start with Russian and Ukranian equities, using country indices to capture the aggregate effect on these markets, from the invasion:

|

| Russia: RTX Russian Traded $ Index, Ukraine: Ukraine PFTS Index |

A knee-jerk contrarian strategy may indicate that you should be buying all these stocks, as soon as they open for trading, but a note of caution is needed. The price drop in these companies, especially severe at Sberbank, is not necessarily an indication that these companies will cease to exist, but that the Russian government may effectively nationalize them, leaving equity worthless.

It is no surprise that Eastern Europe and Russia, which are in the eye of the hurricane, have seen the most damage to equities, but other than the Middle East, every other equity market in the world is down, with the US, EU and China shedding significant market capitalization. Slicing the data based on sector yields the following:

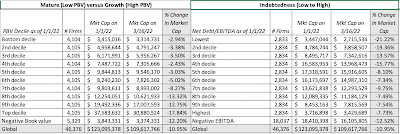

Against, there are no surprises, with energy being the only sector to post positive returns and with consumer discretionary and technology generating the most negative returns. Finally, I looked at firms based upon price to book ratios as of January 1, 2022, as a rough proxy for growth/maturity, and at net debt to EBITDA multiples, as a measure of indebtedness:

Flight to Safety and Collectibles

|

| Trade-weighted dollar & US 10-year T.Bond Rate |

Economic Consequences

It is difficult to argue that people were taken by surprise by the events unfolding in the Ukraine, since the lead in has been long and well documented. It can be traced back to 2014, when Russia annexed Crimea, setting in motion a period of uncertainty and sanctions, and the global economy and Russia seemed to have weathered those challenges well. As this crisis plays out in financial markets, roiling the price of risk in both bond and equity markets, the other question that has to be asked is about the long term economic consequences of the crisis for the global economy.

Commodity Prices and Inflation Expectations

Given Russia’s standing as a lead player in commodity markets, and its role in supplying oil and gas to Europe specifically, it should come as no surprise that the markets for the commodities that Russia produces in abundance has been the most impacted, at least in the short term:

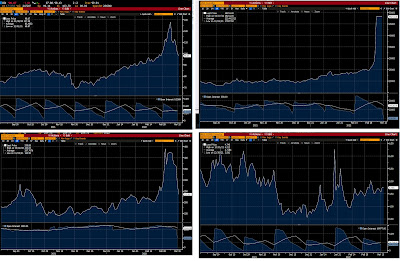

In a market already concerned about expected inflation, the rise in commodity prices operated as fuel on fire, and pushed expectations higher. In the graph below, I list out two measures of expected inflation, one from a inflation expectations ETF (ProShares Inflation Expectation ETF) and the other from the Federal Reserve 5-year forward inflation measure, computed as the difference between treasury and TIPs rates.

Both measures indicate heightened concerns about future inflation, and these are undoubtedly also behind the increase in the US ten-year treasury bond rate from 1.51% to 2.19%, this year.

Consumer Confidence and Economic Growth

The question that hangs over not just markets but economic policy makers is how this crisis will affect global economic growth and prospects. It is too early to pass final judgment, but the early indications are that it has dented consumer confidence, as the latest reading from the University of Michigan consumer survey indicates:

|

| University of Michigan Consumer Sentiment |

Consumer sentiment is now more negative than it was at any time during the COVID crisis in 2020, and if consumers pull back on purchases, especially of discretionary and durable goods, it will have a negative effect on the economy. While the contemporaneous numbers on the US economy on unemployment and production still look robust, worries about recession are rising, at least relative to where they were before the hostilities. The graph below looks at the median forecasts of recession probabilities for the US, on the left, and for the Eurozone, on the right (from Bloomberg):

|

| Median forecast probability of recession, US (left) and Eurozone (right) |

As a result of the events of the last three weeks, forecasters have increased the probabilities of recessions from 15% to 20% for the US and from 17.5% to 25% for the Eurozone.

Investment Implications: Asset Classes, Geographies and Companies

The Russian invasion of Ukraine has undoubtedly increased uncertainty, affected prices for financial assets and commodities and exacerbated issues that were already roiling markets prior to the invasion. For investors trying to recapture their footing in the aftermath, there are multiple questions that need answers. The first is whether a radical shift in asset allocation is needed, given how these perturbations, across asset classes, geographies and sectors. The second is how the disparate market sell off, small in some segments and large in others, over the last few months has altered the investment potential in individual companies in these segments. On January 1, 2022, I valued the S&P 500, building in the expectation that the economy would stay strong for the year and that interest rates would rise over the course of time from the then prevailing value (1.51%) to 2.50% over five years, and arrived at a value of 4,320 for the index, about 10.3% lower than the traded value of 4766. While that was only ten weeks ago, the index has since shed 7.03% of its value, the T.Bond rate has risen to 2.19% and Russia’s invasion of the Ukraine have increased commodity prices and the likelihood of a recession. I revisited my valuation of the index, with the updated values:

|

| Spreadsheet to value the S&P 500 |

- If you are a knee-jerk contrarian, your default belief is that markets over react, and you would be buying into the most damaged asset classes, which would include US, European and Chinese stocks (worst performing geographies), and especially those in technology and consumer discretionary spaces (worst performing sectors), and selling those investments (energy companies and commodities like oil, that have benefited the most from the turmoil.

- If, on the other hand, you believe that investors are not fully incorporating the effects of the long term damage from this war, you would reverse the contrarian strategy, and buy the geographies and sectors that have benefited already and sell those that have been hurt.

As an avowed non-market-timer, I think that both these strategies represent bludgeons in a market that needs scalpels. Rather than make broad sector or geographic bets, I would suggest making more focused bets on individual companies. In picking these companies, market corrections, painful though they have been, have opened up possibilities, for investors, though their stock picks will reflect their investment philosophies and their views on economic growth:

- Discounted Tech: During the course of 2022, markets have reassessed their pricing of tech stocks, and marked down their market capitalizations, for both older, and profitable tech and young, money-losing but high growth tech. A few weeks ago, I posted my valuation of the FANGAM stocks and noted that only one of them was under valued, at the prices prevailing then. In the last few days, every company on the list has dipped in price by enough to be at least fairly valued or even cheap. While there may be value in some young tech companies, any investments in these firms will be joint bets on the companies and a strong economy, and with the uncertainties about inflation and economic growth overhanging the market, I would be cautious.

- Safety First: If you have been spooked by market volatility and the Russian crisis, and believe that there is more volatility coming to the market in the rest of the year, your stock picks will reflect your fears. You are looking for companies with pricing power (to pass through inflation) and stable revenues, and in my view, and while you should start by looking in the conventional places (branded consumer products and food processing, pharmaceuticals), you should also take a look at some of the big names in technology.

- The Russia Play: For the true bargain hunters, the wipeout of market capitalization of Russian stocks (like Sberbank, Severstal, Lukoil and Yandex) will create temptation, but I would offer two notes of caution. The first is that you have to decide whether you can buy them in good conscience, and that is your judgment to make, not mine. The second is that corporate governance at Russian companies, even in their best days, is non-existent, and I do not know how this crisis will play out in the long term, at these companies. After all, your ownership stake in these companies is only as good as the legal structure backing it up, and in Russia, that your stake may be worthless, even if these companies recover. A less risky route would be to tag companies with significant exposure to Russia, such as Pepsi, McDonald’s and Philip Morris, and evaluate whether the market is overreacting to that exposure. I have seen no evidence, so far, that this is the case, but that may change.

- Implied ERP, by day, for S&P 500: January 1, 2022 – March 16, 2022

- Market Capitalization % Change, 1/1/22 – 3/16-22, by Region

- Market Capitalization % Change, 1/1/22 – 3/16-22, by Price to Book Ratio

- Market Capitalization % Change, 1/1/22 – 3/16-22, by Sector

- Market Capitalization % Change, 1/1/22 – 3/16-22, by Net Debt/EBITDA