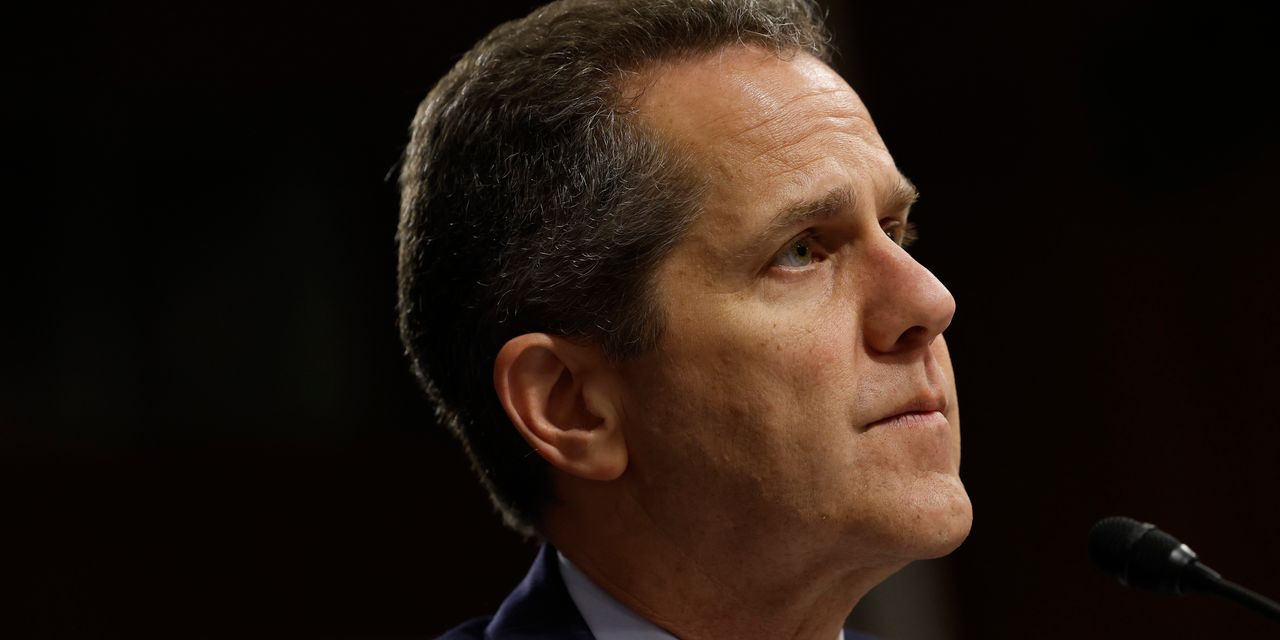

: Fed vice chair of supervision Michael Barr proposes new capital requirements for banks with $100 billion or more in assets

Michael S. Barr, vice chair for supervision at the U.S.. Federal Reserve, on Monday said he’s leading a multi-year effort to increase capital requirements for banks. Among the many regulatory recommendations by Barr to be introduced over time is to apply enhanced risk-based capital rules to banks with $100 billion or more in assets, down from a threshold of $700 billion. “Our recent experience shows that even banks of this size [$100 billion in assets] can cause stress that spreads to other institutions and threatens financial stability,” Barr said in his speech at the Bipartisan Policy Center. “The risk of contagion implies that we need a greater degree of resilience for these firms than we previously thought.” Barr is proposing to require banks with assets of $100 billion or more to account for unrealized losses and gains in their available-for-sale (AFS) securities when calculating their regulatory capital. “This change would improve the transparency of regulatory capital ratios, since it would better reflect banking organizations’ actual loss-absorbing capacity,” Barr said. “Realizing the losses from these securities, without adequate capital to protect from those losses, was an important part of the set of events that triggered the run on Silicon Valley Bank (SVB).”

Market Pulse Stories are Rapid-fire, short news bursts on stocks and markets as they move. Visit MarketWatch.com for more information on this news.