Top places to buy Decentralized Social, which gained 64% in 24 hours

After Elon Musk tweeted that people need a new decentralized social medium because Twitter isn’t doing the job, platforms like Decentralized Social began to enjoy newfound popularity.

If you want to know what Decentralized Social is, can it give you good returns, and the top places to buy Decentralized Social, you’ve come to the right place.

Top places to buy Decentralized Social now

What is Decentralized Social?

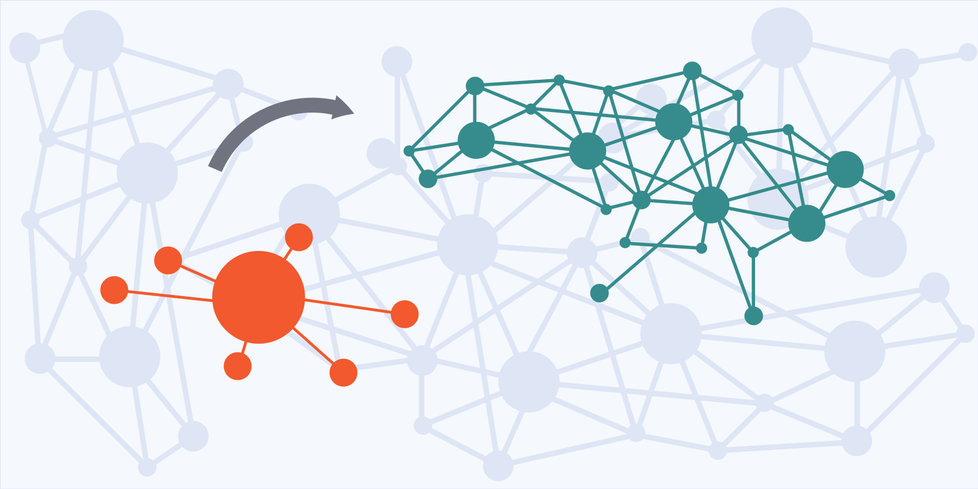

Decentralized Social (DESO) bills itself as the world’s first layer-1 blockchain custom-built to scale decentralized social applications to billions of users.

The innovative blockchain was created in 2019 with the purpose of powering Web3 decentralized social networks. It has aimed to solve the problems created by present social media centralization ever since.

Unlike conventional social media, DESO’s social blockchain treats content as a public utility. Anyone can gain access to it. The platform combines efficient and scalable database infrastructure with the paradigm of the open P2P financial system cryptocurrencies offer.

The end product is customized to bring about the next generation of Web3 social media. Hundreds of apps have been built on the DESO blockchain so far.

Should I buy Decentralized Social today?

Nothing can substitute doing your own research. Any investment decision you make should be based on your market expertise, your attitude to risk, and the features and spread of your portfolio. Also, consider how you would feel about losing money.

Decentralized Social price prediction

Tech News Leader predicts the price of DESO will reach $64.90 this year. In 5 years, 1 DESO will be worth $193.33. DESO will have broken $1,000 in a decade. It will be worth $1,147, according to the analyst.

Decentralized Social on social media

There is so much on the horizon for DeSo and our community.

Since launch, there has been 1.5M wallets created and $17.2M has been made by DeSo creators.

We are just getting started.

Make sure to check out @openprosper for more DeSo stats here 👇 https://t.co/KhgvTlCpYX pic.twitter.com/Tx8eJd98UH

— DeSo (@desoprotocol) March 10, 2022

The post Top places to buy Decentralized Social, which gained 64% in 24 hours appeared first on Coin Journal.